Flat rate depreciation calculator

Loan Amount Loan Term years. Double Declining Balance Method.

Depreciation Of Assets 1 Of 3 Flat Rate Depreciation Youtube

How Depreciation Is Calculated.

. This depreciation calculator will determine the actual cash value of your Trailers using a replacement value and a 15-year lifespan which equates to 015 annual depreciation. Flat-rate methods use a calculation basis of either the recoverable cost or recoverable net book value to calculate annual depreciation. Depreciable Value per Year Depreciation Rate purchase Price of Machine Salvage Value Depreciable Value per Year 5 500000 100000 Depreciable Value per Year 20000.

From RM 269k 52 seating. Flat Rate EMI Calculator. Assets determines the depreciation rate using fixed rates including the basic rate adjusting rate and bonus rate.

Flat rate depreciation calculator Related Articles. This depreciation calculator will determine the actual cash value of your Flat Built-Up using a replacement value and a 12-year lifespan which equates to 012 annual depreciation. Expertly Manage the Largest Expenditure on the Balance Sheet with Efficiency Confidence.

Depreciation Amount Asset Value x Annual Percentage. Percentage Depreciation Calculator Asset Value Percentage Period Results The calculator uses the following formulae. With this method the depreciation is expressed by the total number of units produced vs.

Assets depreciating under flat-rate methods with a. Depreciation asset cost salvage value useful life of asset 2. USB ports to keep.

2020 Mercedes-Benz GLB launched in Malaysia. Assets determines the depreciation rate using fixed rates including the basic rate adjusting rate and bonus rate. Oracle Assets uses a flat-rate and either the recoverable cost or.

For a loan tenure of 3 years with flat interest rate of 1200 the total interest amount is 36000. There are many variables which can affect an items life expectancy that should be taken into consideration. Depreciation Calculation for Flat-Rate Methods.

Depreciation per year Asset Cost - Salvage Value Actual Production Estimated Total Production in Life Time Partial Year Depreciation See more. The calculator should be used as a general guide only. Flat rate depreciation calculator.

How Depreciation Is Calculated. Cost of machine 10000 Scrap value of machine 1000 Machines estimated useful life 5 years Annual Depreciation Cost of Asset Net Scrap ValueUseful Life. This depreciation calculator will determine the actual cash value of your Suitcases using a replacement value and a 20-year lifespan which equates to 02 annual depreciation.

The total number of units that the asset can produce. Yearly Depreciation Value 2 x straight-line depreciation rate x book value at the. Use a flat-rate method to depreciate the asset over time using a fixed rate.

The Platform That Drives Efficiencies.

Depreciation Calculation

Depreciation Of Assets 1 Of 3 Flat Rate Depreciation Youtube

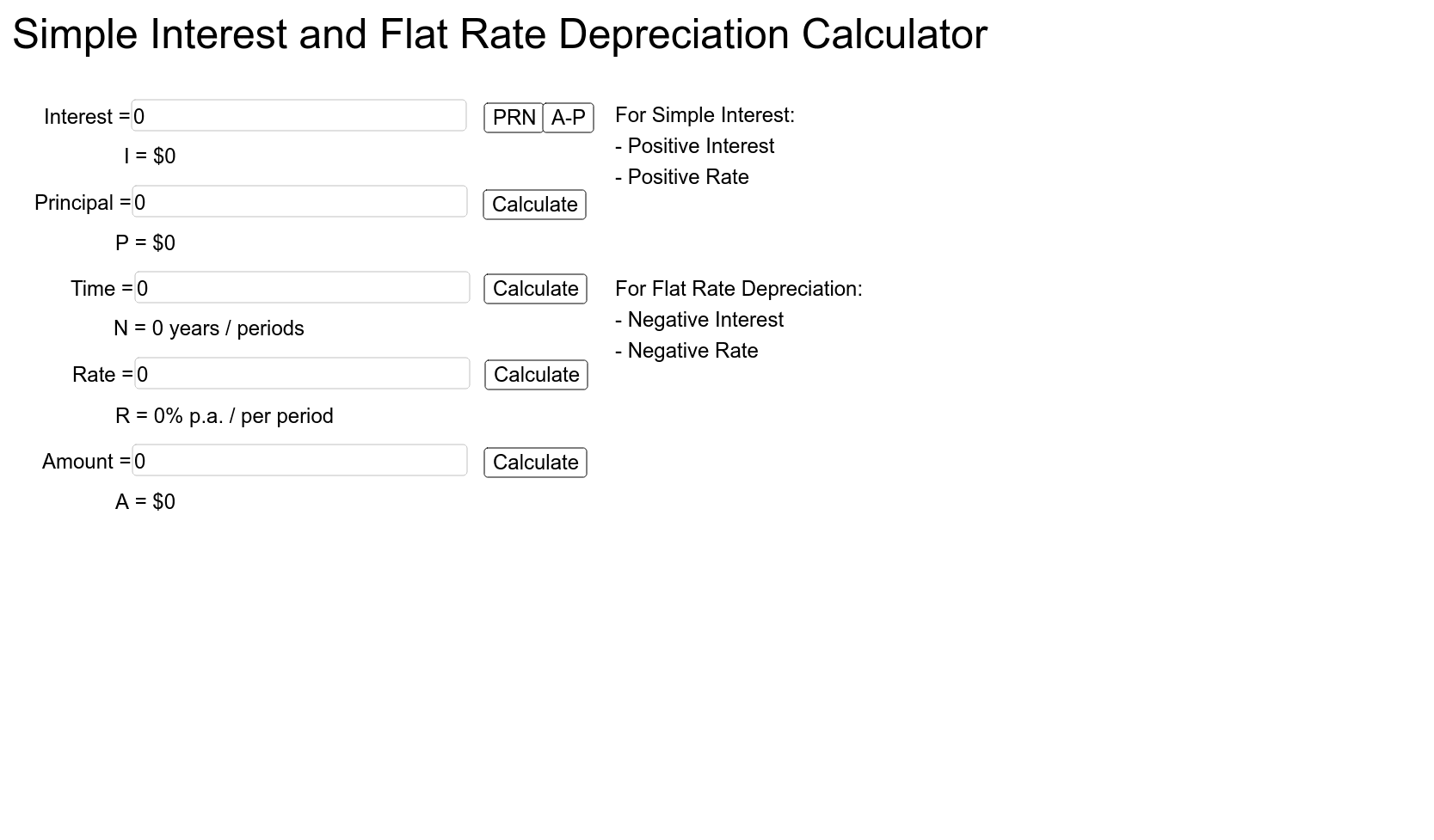

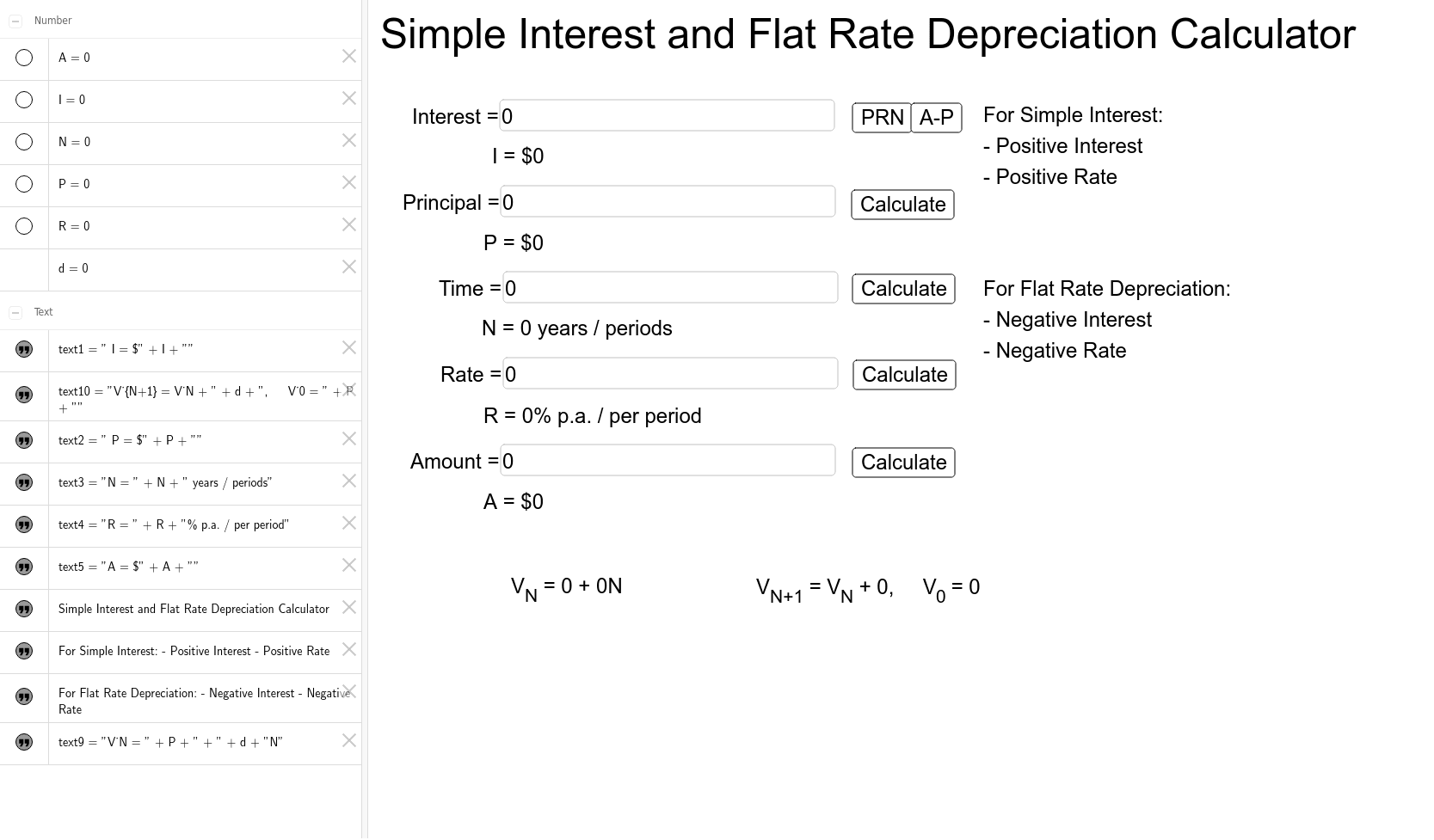

Simple Interest And Flat Rate Depreciation Calculator Vce Geogebra

Depreciation Rate Calculator Cheap Sale 60 Off Www Ingeniovirtual Com

Flat Rate Depreciation General Formula Example Youtube

Flat Rate Depreciation Recurrence Example Youtube

Lesson 8 8 Appreciation And Depreciation Youtube

Depreciation Formula Calculate Depreciation Expense

Effective Interest Rate Formula Calculator With Excel Template

Simple Interest And Flat Rate Depreciation Calculator Geogebra

2

Depreciation Formula Calculate Depreciation Expense

How To Use The Excel Db Function Exceljet

Depreciation Rate Formula Examples How To Calculate

Depreciation Calculation For Flat Rate Methods Oracle Assets Help

Simple Interest And Flat Rate Depreciation Calculator Vce Geogebra

Depreciation Calculation For Flat Rate Methods Oracle Assets Help